Why Are People Selling Their Homes To Real Estate Investment Companies?

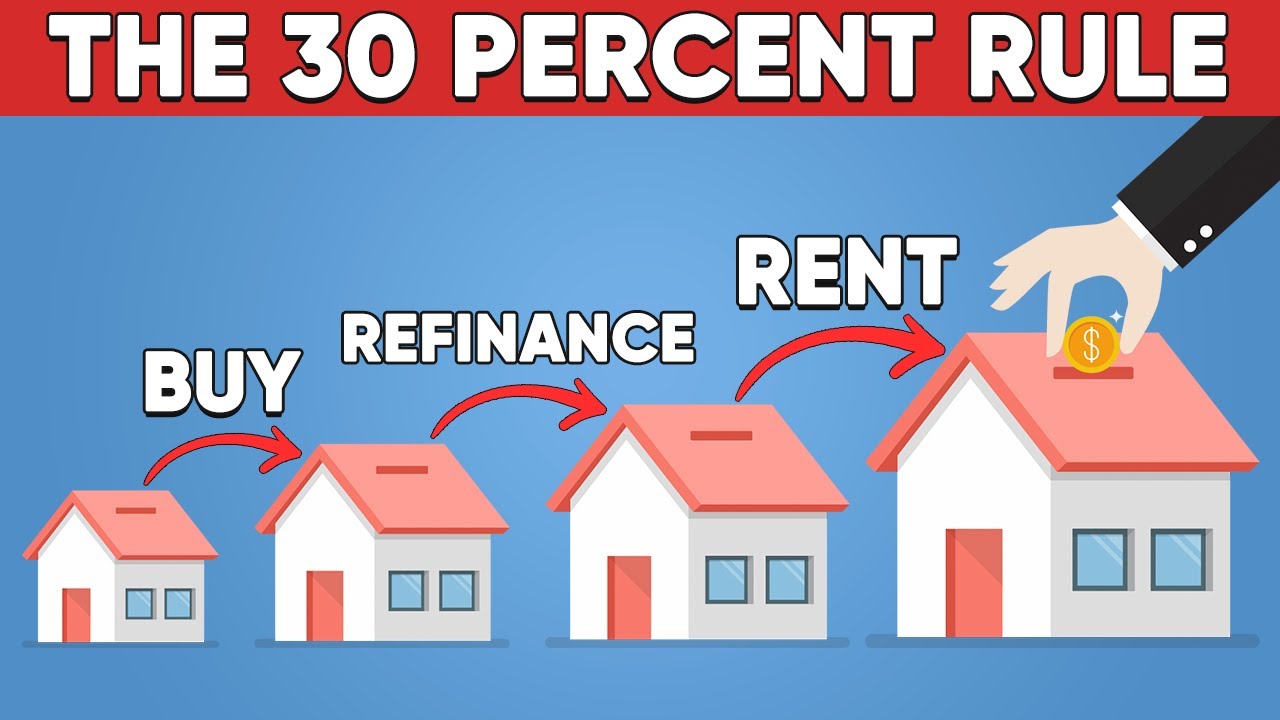

If homeowners decide to sell their home, the most frequently asked question is whether to sell to a regular buyer or an investment company. Each has advantages and disadvantages So let's look at what to expect should you choose the investment firm.

Selling your home instead of leasing it, is more beneficial than renting it out. You'll usually be able to get more for your home than the monthly rental. Selling your home through an investment firm will allow you to avoid having to deal with prospective buyers. You won't have to deal with potential buyers making an offer that is too low, or the buyer making a bunch of repairs, only to walk out once it's time for closing. The fact that you've made the decision to sell your home via an investment company does not mean that you'll be able to skip over the paperwork. While you'll still have to file the paperwork but the process will be much less stressful.

When you choose this option it is important to know that the buyer will likely require everything to be in order before they even begin the purchase. They'll require a clear title and a clear chain. An investment company will allow you to immediately put everything in writing. This will save you a lot of time and effort. Investment companies will guide you through the paperwork faster than the average buyer.

Selling your home to an investment firm is becoming a very popular option for many. It's easy to understand why this route is so well-known. You could earn more than the rent you pay monthly for your home if decide to sell the property in this manner. You don't need to bargain with prospective buyers who may decide to cancel the deal. So be sure that you're making the right choice when it comes time to sell your home.

The market for real estate has experienced a surge in recent times and everyone is eager to take advantage of this fantastic opportunity. But there's a down side to all this success: People rent out their properties instead of retaining them. What is the reason? Are homeowners selling their homes due to the fact that they have the money or do they have other motives? To answer these questions and more, I'd like to publish an article about what has prompted the recent nationwide trend of people selling their homes to real estate investment corporations? This is due to a myriad of reasons. There are many reasons people choose to rent their homes instead of keeping them.

Real Estate Investment Companies (REICs) have been around for a long time and are a well-established phenomenon. Their history can be traced all the way back to Colonial times. Some believe that REICs founded as a way to dodge taxes or because shady business people wanted to profit from others. REICs are a fact that has existed for quite a while. They were utilized to invest money.

The term "real estate" refers to a combination of several types of property. The house and any other structures on the property, such as the garage or swimming pool, are the most commonly used notions of real estate. However, real estate could also comprise commercial buildings and vacant land as well as apartments. There aren't any legal limitations on what property is included in an REIC portfolio. It is all dependent on your investment philosophy.

Professional managers who also serve as portfolio managers run real estate investment companies. They are required to adhere to specific guidelines on how they conduct business and invest their money, as well as what their portfolios are exposed to. However, it is not always feasible to perform this in the most efficient way. This leads me to the following topic.

REICs cannot guarantee returnsbecause each real estate investment is uncertain. It is possible to earn substantial returns, but even extraordinary returns are possible when you purchase the right property. The possibility of losing money in any investment is there. You give an REIC the authority to manage and utilize your funds in the way they want.

REICs do what's the best for their investors for example, investing in property that is not suitable , and thus placing both the investor and themselves at risk. REICs do not operate as real estate entities. They're investment organizations. Real estate is unique from other types of property because it is something that we actually use every day. It is more emotionally charged than other investments, making it more important. REICs aren't real estate companies. REICs aren't real estate companies. Why should you choose REICs as an investment option over other options? REIC investors often feel they're better equipped to protect themselves against the fluctuations of the economy because they use this investment vehicle. Another common misconception is that REICs are usually tax-efficient. REICs' unique structure has been extensively reported to lower tax burdens for investors. These institutions pay taxes but the investor pays only taxes on dividend and capital gains income.

REICs cannot be tax-efficient. REIC investors might feel the company is not paying taxes since the investor is required to pay taxes. REICs do not have to pay local or state taxes on rent in the event that they own their own house. The benefit of owning your home is the flexibility you enjoy with your home. There is a possibility of taxation if you rent out certain portions of the property. If you decide to renovate or upgradeyour property, this could also be taxed by government entities. While you might not be able to charge the local government for these kinds of choices, you could. Your REIC would. REICs operate under strict guidelines, and can be subject to harsh fines for any violation.

An important advantage to investing in REICs over the other We Buy Houses Philadelphia types is the strictness of regulation. Most people know that investing in futures, stocks, and bonds involves substantial risks. This is why REICs must be strictly controlled. REICs are not included in the regulations. REIC investors are often convinced they are able to shield themselves from the volatility and downs of the economic cycle by using this investment vehicle.